How we worked together to achieve more.

The Field Services Payment Problem For contractors, home repair specialists, and field technicians, getting paid should be the easy part of the job. Unfortunately, it is often the hardest. Many field service businesses still rely on outdated payment methods like paper invoices, mailed checks, or clunky mobile card readers. These approaches create unnecessary delays, lost... »

The Future of Lending Is Already Here Imagine applying for a loan and receiving approval, signing documents, and getting funds deposited, all within a single conversation on your phone. For many financial institutions, this vision is closer than it seems. The combination of artificial intelligence (AI), Rich Communication Services (RCS), and secure pay-by-text is transforming... »

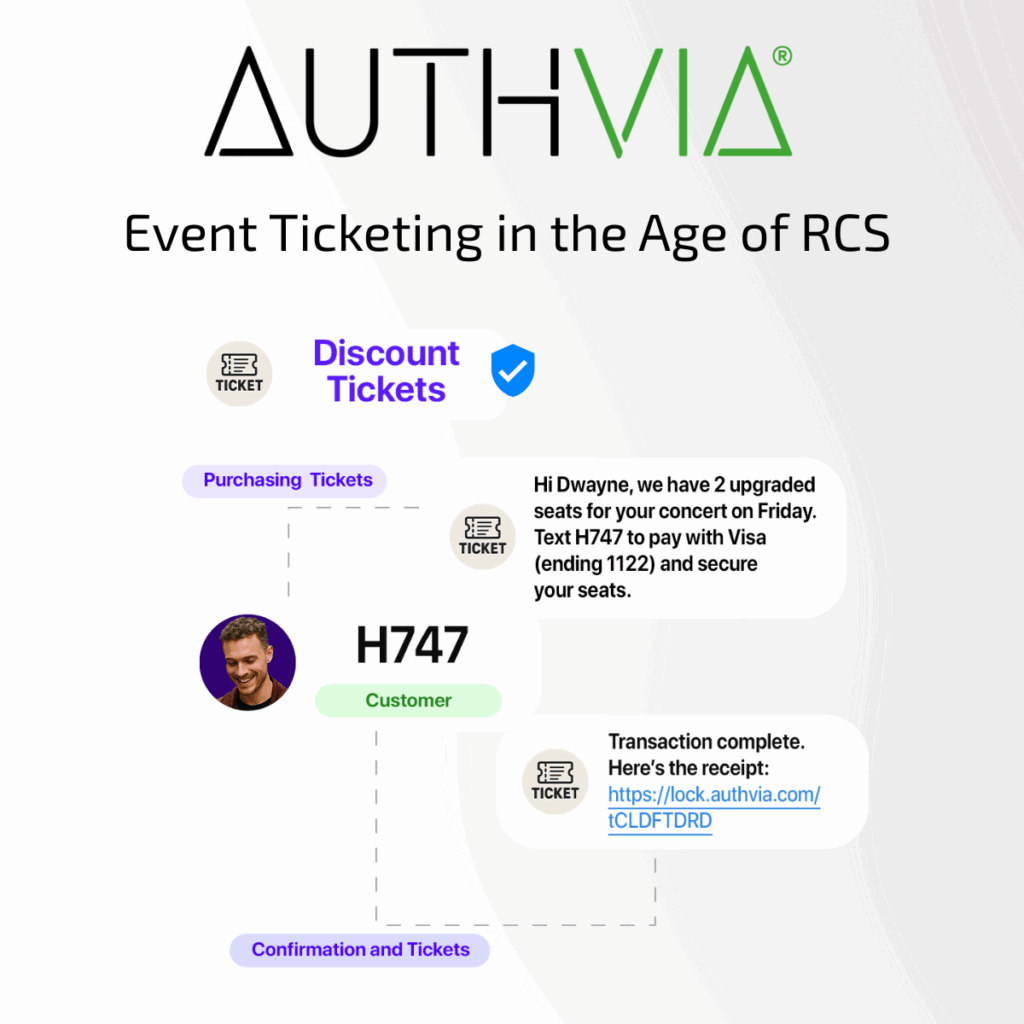

A New Era for Live Events Buying tickets once meant standing in line or refreshing a website at midnight, hoping to secure a spot. Even with today’s digital platforms, the experience can still feel clunky: too many clicks, slow confirmations, lost emails, and upsell offers hidden in separate messages. In the age of instant messaging,... »

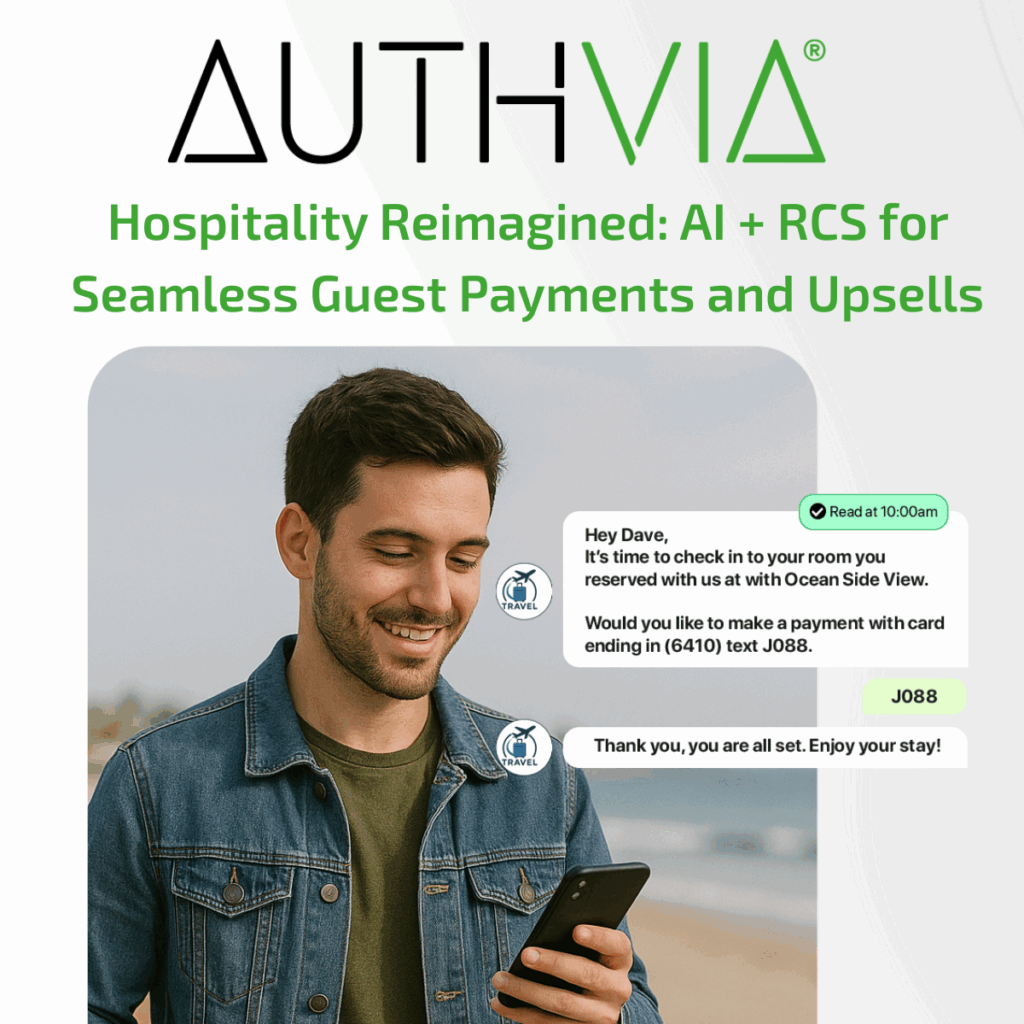

The Hospitality Experience Is Changing Travelers today expect more than a comfortable room; they expect convenience at every touchpoint of their journey. From the moment a guest books a vacation rental to the day they check out of a resort, every interaction shapes their overall experience. Yet many hospitality businesses still rely on outdated processes:... »

In the field services industry, efficiency is everything. Whether it’s HVAC repair, pest control, or home maintenance, technicians spend their day juggling appointments, work orders, and customer payments. Yet many teams still rely on outdated tools, paper invoices, phone calls, and clunky portals, that slow down job completion and delay revenue. As customer expectations rise,... »

Introduction: The Subscription Economy’s Biggest Threat Subscription-based businesses, whether streaming platforms, fitness apps, or meal delivery services, live and die by one metric: retention. Winning a customer is just the beginning. The real challenge is keeping them engaged and paid up month after month. Yet churn is a constant threat. Forgotten renewals, failed payments, and... »

The Cost of Outdated Billing For healthcare providers, the challenge of collecting payments is as critical as providing care. Patients face confusing billing processes, long delays, and outdated payment options. On the provider side, staff are bogged down with administrative tasks, revenue cycles stretch out for months, and bad debt continues to rise. Traditional billing... »

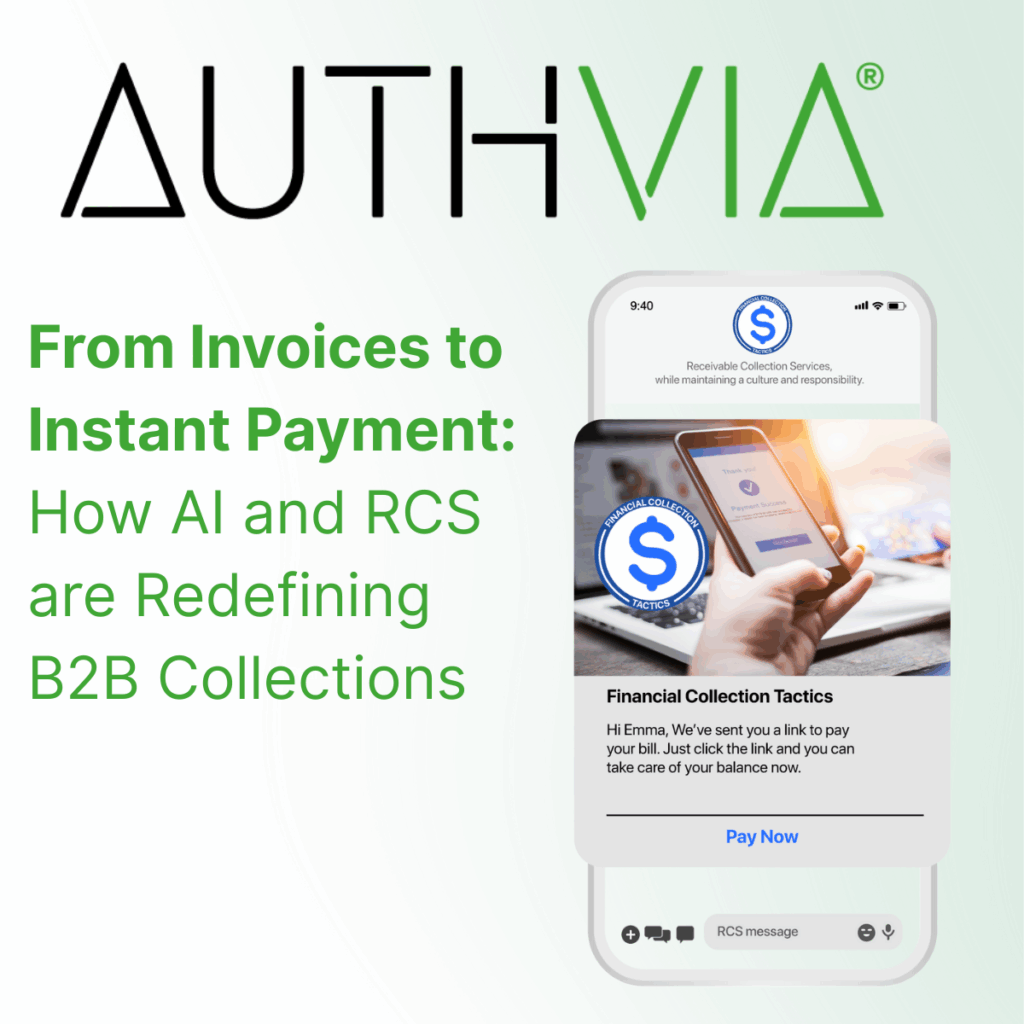

The Broken State of B2B Collections Every business depends on steady cash flow, yet most still rely on outdated methods to collect payments. Traditional invoicing and collections processes are slow, manual, and inconsistent. Teams spend hours chasing overdue accounts, customers ignore email reminders, and phone calls often create tension rather than resolution. This outdated approach... »

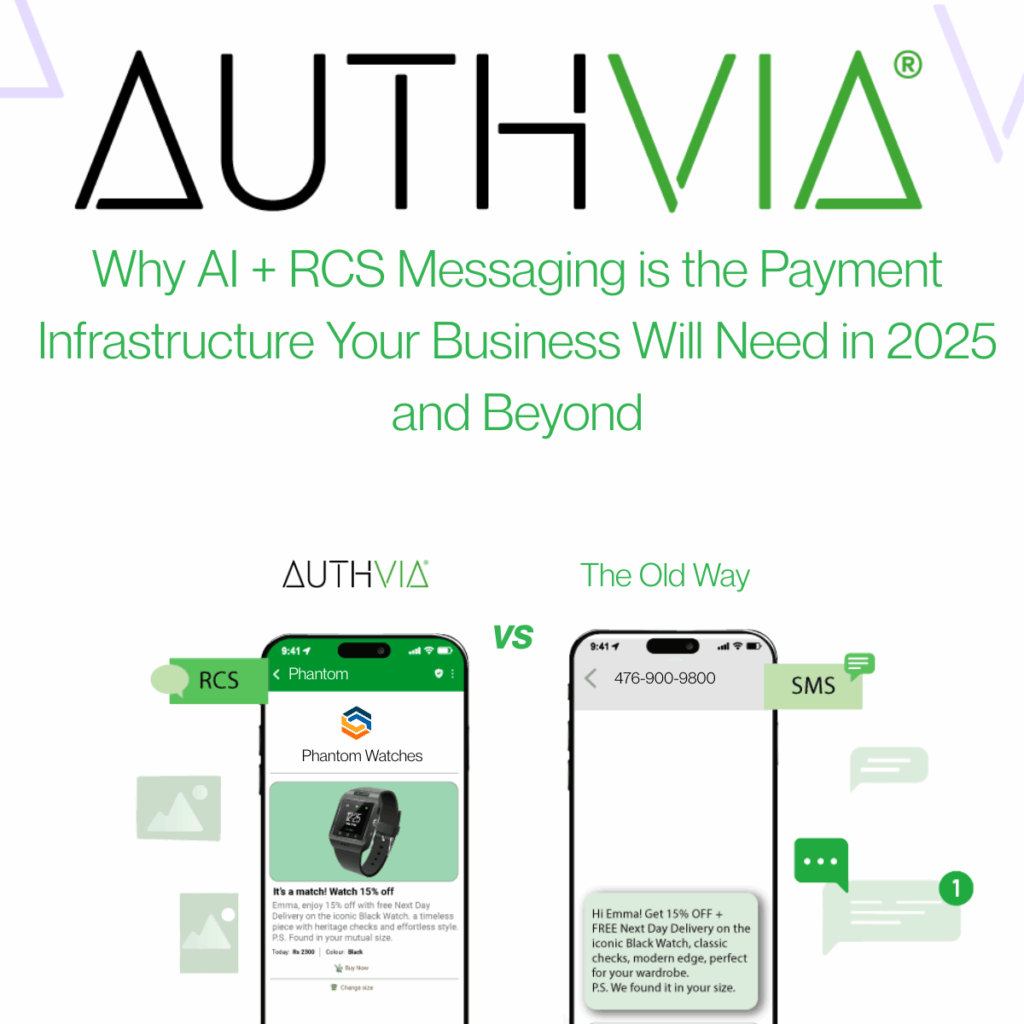

In 2025, the speed of commerce is no longer dictated by business hours, phone calls, or website logins, it’s dictated by conversations. Across industries, consumers expect instant answers, personalized offers, and the ability to complete transactions without leaving their preferred messaging channel. That’s why the next wave of payment infrastructure isn’t just about faster processing... »

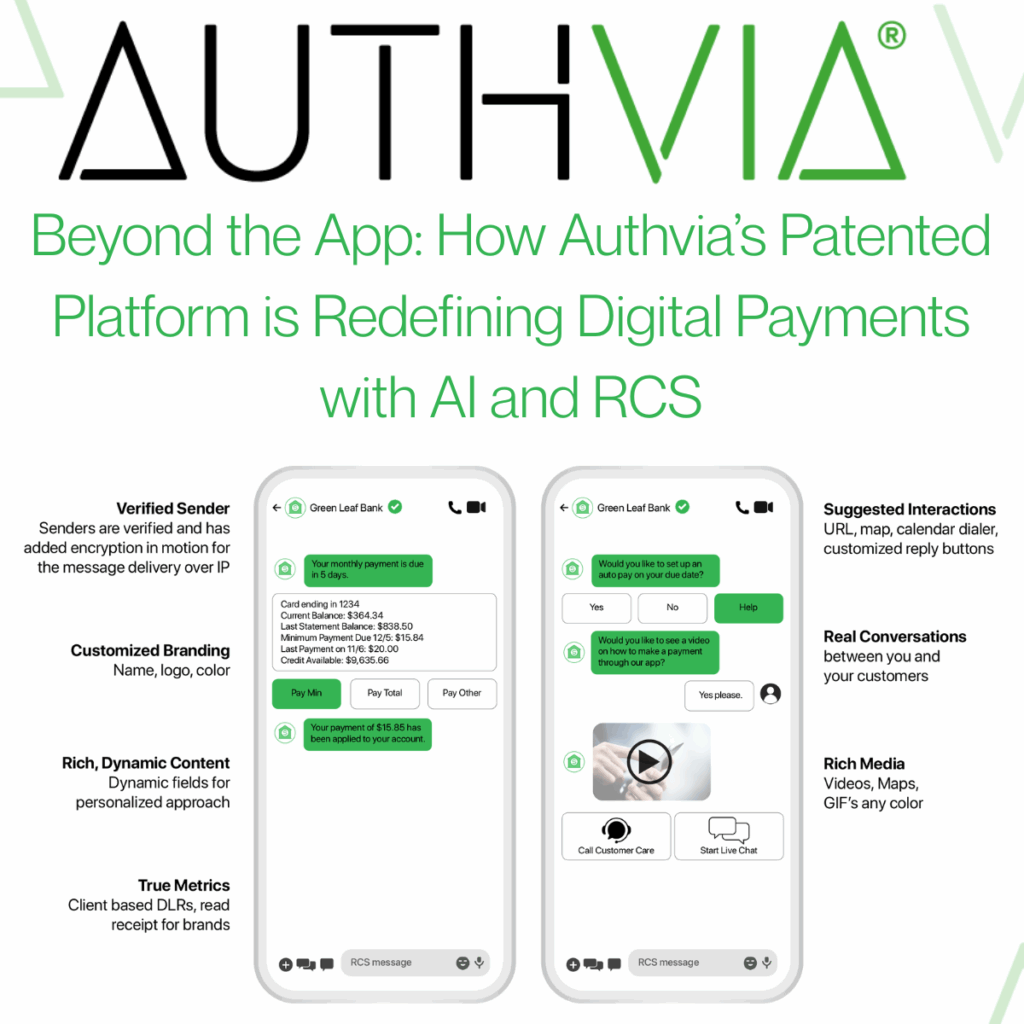

The digital payment landscape is changing fast and clunky portals, password resets, and outdated app downloads are quickly becoming relics of the past. Today’s consumers expect fast, secure, and frictionless ways to pay, right from the messaging channels they already use. Enter Authvia, the only platform with patented technology that seamlessly combines AI, RCS, and... »

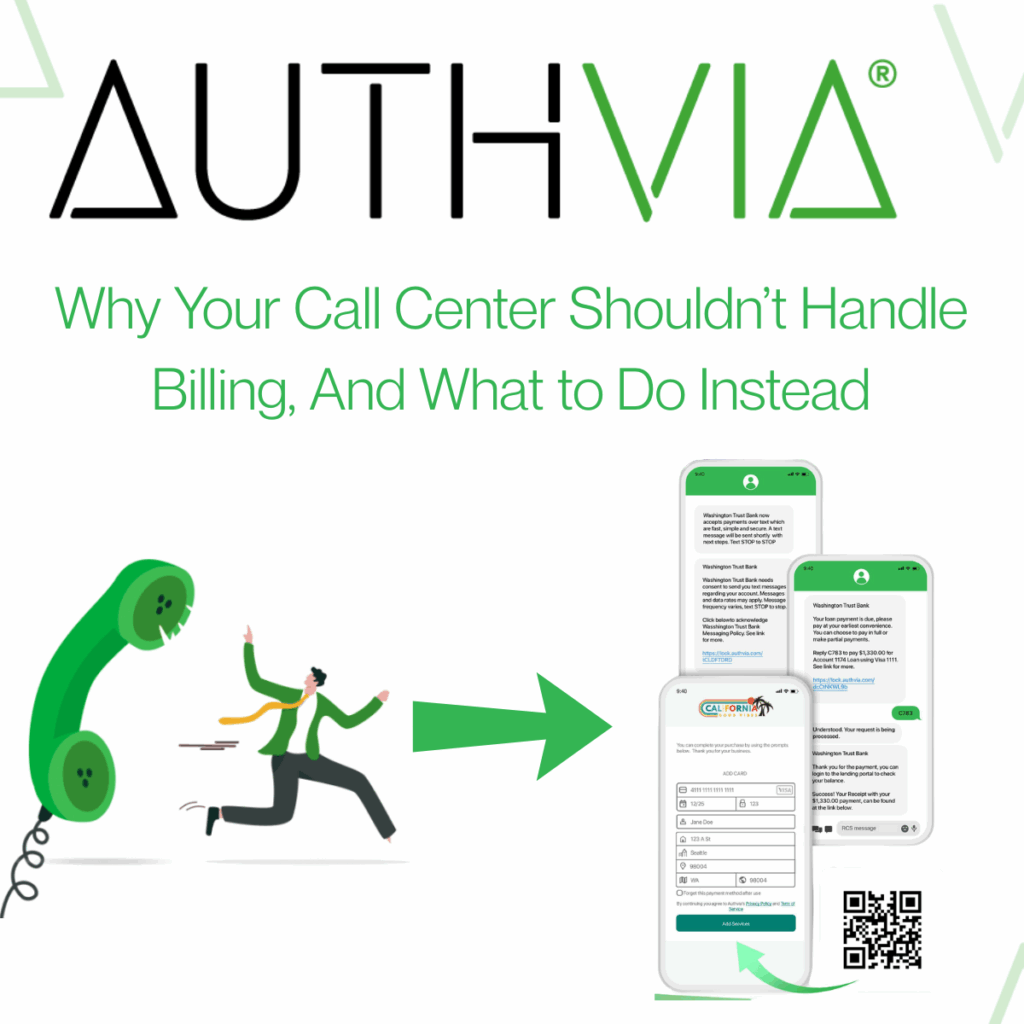

In the world of customer support, every minute an agent spends on a call managing billing or payment questions is a minute taken away from resolving real service issues. For companies relying on call centers to process payments or handle billing, the costs, both financial and reputational, are stacking up fast. If your team is... »

Homeowners associations (HOAs) play a critical role in maintaining property values and fostering vibrant communities, but far too many boards and office staff find themselves acting more like bill collectors than community leaders. Collecting dues, chasing late payments, managing reminders, and handling disputes isn’t just time-consuming, it puts unnecessary strain on volunteers, distracts from core... »