For many businesses, the collections process has quietly become an operational burden that no one planned for and even fewer are equipped to manage. Whether you’re a healthcare provider, subscription-based business, HOA, property manager, or insurance carrier, if you’re spending significant time, labor, and technology resources chasing down overdue payments, you’ve effectively taken on the role of a collections agency. And it’s costing you more than you think. It’s time to think about outsource collections as a strategic game changer.

The Hidden Cost of In-House Collections

When businesses try to manage collections internally, they often underestimate the true cost:

- Labor and overhead: AR teams spend countless hours following up on payments, sending reminders, and reconciling accounts. This time could be better spent on growth-driving activities.

- Lost revenue: Delayed payments often result in lower recovery rates. According to ACA International, after 90 days overdue, the chance of collecting falls below 50%.

- Compliance risk: Collections are heavily regulated. TCPA, FDCPA, and HIPAA violations can lead to costly legal exposure. Most businesses aren’t built to navigate this complexity.

- Customer churn: Aggressive or repetitive outreach can alienate loyal customers. Poor payment experiences lead to disengagement and lost renewals.

What begins as a simple follow-up becomes a distracting, costly, and risky operation that eats into your margins and your brand.

Why Leading Businesses Are Outsourcing Collections

Outsourcing collections doesn’t mean surrendering control, it means partnering with a platform like Authvia that empowers you to collect faster, stay compliant, and deliver a modern customer experience.

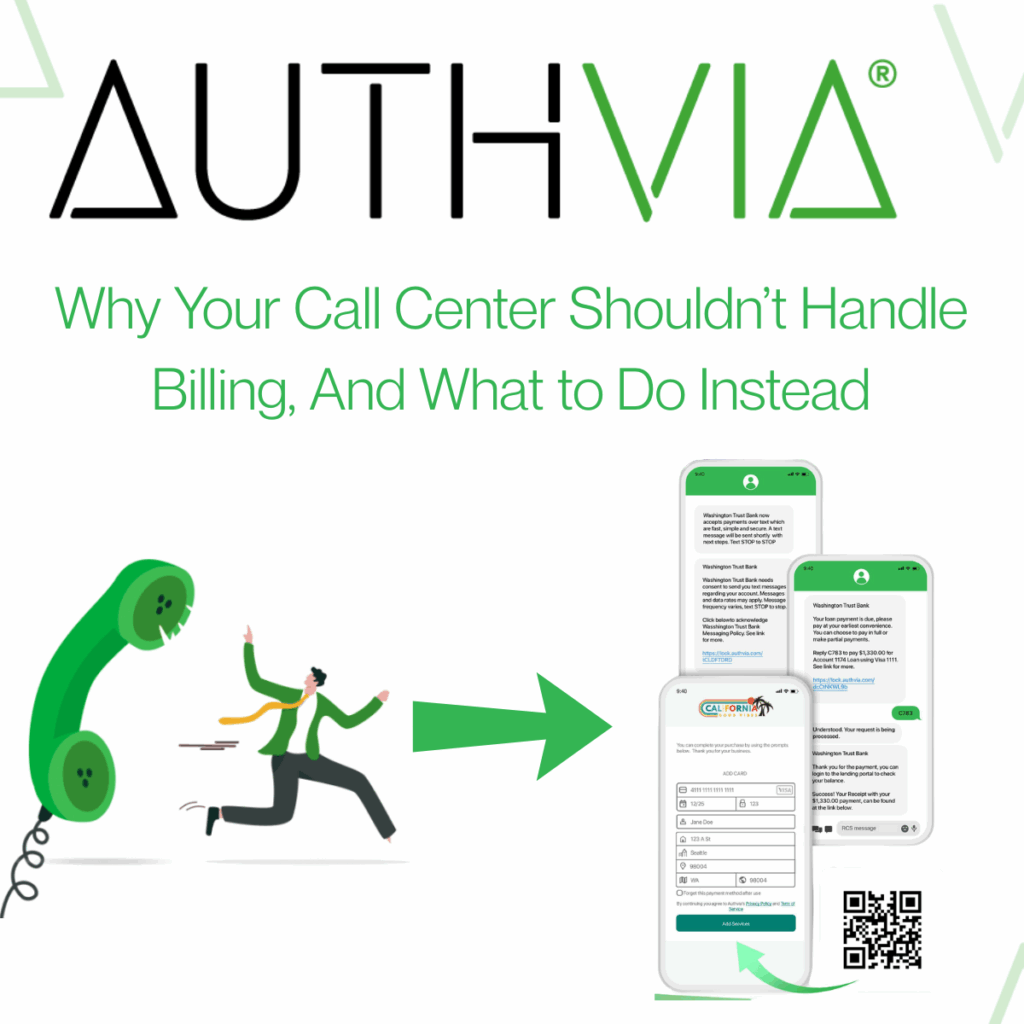

Using Authvia’s patented TXT2PAY® platform, businesses can send secure, tokenized payment requests directly through messaging channels like SMS, RCS, and email. No portals. No logins. No friction.

Key benefits of using Authvia Managed Services:

- Automated batch billing: Eliminate manual processes by uploading customer balances and letting the platform manage outreach.

- Frictionless payment options: Customers pay in seconds from their phone, without apps or complicated logins.

- Compliance built in: All outreach and payments are PCI-compliant and TCPA-friendly, keeping you out of regulatory hot water.

- White-labeled and brand-aligned: The experience feels like it’s coming from you, not a third party.

- Quick implementation: Onboarding is simple, often completed in days, not weeks. You don’t have to rip and replace your existing systems.

Industry Use Cases That Prove It Works

- Healthcare: Clinics using Authvia’s managed services have reduced average days to collect by over 40%, while maintaining HIPAA-compliant messaging.

- HOAs and Property Management: Automated billing cycles have improved dues collection rates and reduced community friction.

- Subscription-based businesses: Pay-by-text capabilities improve renewal rates by offering customers a more convenient, app-free payment flow.

- Insurance and Financial Services: Real-time reminders and payment prompts help avoid policy lapses and customer churn.

Focus on What Matters, Your Customers

Your core business is delivering services, not chasing payments. With the right partner, collections become an automated, integrated, and brand-positive experience.

As a merchant or service provider, outsource collections doesn’t mean losing control, it means reclaiming time, reducing cost, and increasing customer satisfaction. The average business already outsources critical services like IT, payroll, or marketing. Why not collections?

Ready to Get Started?

Getting started with Authvia’s managed services is simple. Our platform integrates with your current payment processor, CRM, or AR system. Whether you use batch files or APIs, we’ll help you get up and running quickly so you can start recovering revenue immediately without hiring new staff or building out complex workflows. It’s time for you to change the collections game and consider outsource collections as a strategic revenue lift.

Stop acting like a collections agency. Let Authvia help you get back to business.Learn more or schedule a demo today at Authvia.