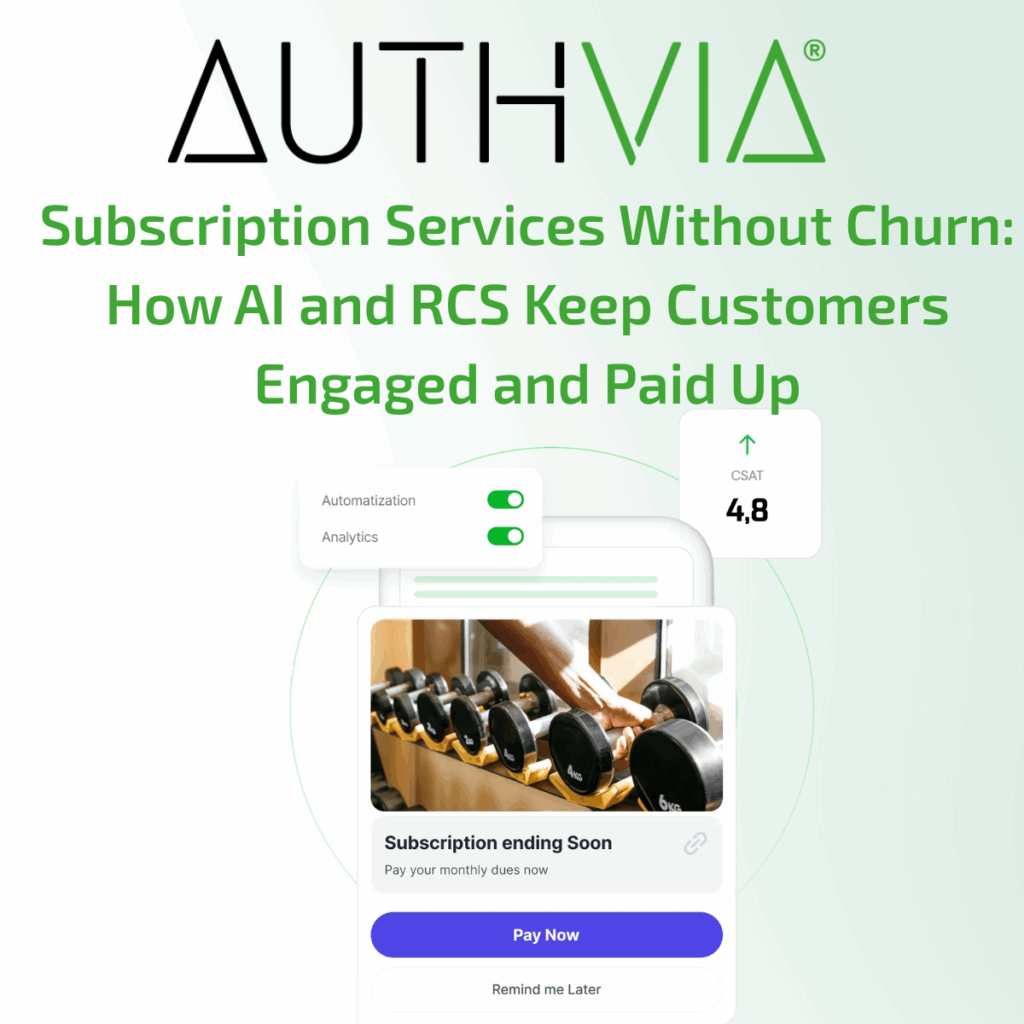

Independent Software Vendors (ISVs) live and die by recurring revenue. Yet even the stickiest SaaS platform can spring a slow leak when merchants struggle with billing, payments, or compliance. The result? Silent churn that erodes monthly recurring revenue (MRR) and keeps customer-acquisition costs sky-high.

The fastest way to plug that leak isn’t another feature release, it’s a managed payments layer that removes friction for merchants and their customers. Early adopters of Authvia’s Managed Services including batch billing, automated dunning, and conversational checkout are reporting churn reductions in the first six months. Here’s why.

Why Billing Friction Sends Merchants Packing

- Complex Gateways & PCI Scope

Small and mid-size merchants rarely have the staff (or the stomach) for PCI audits. If payments feel risky or expensive, they look for simpler options or go back to cash and checks. - Manual Invoice Workloads

Exporting CSVs, stuffing envelopes, and chasing unpaid invoices by phone drains staff time. Merchants blame the software (you) more than their own processes. - Slow Cash Flow

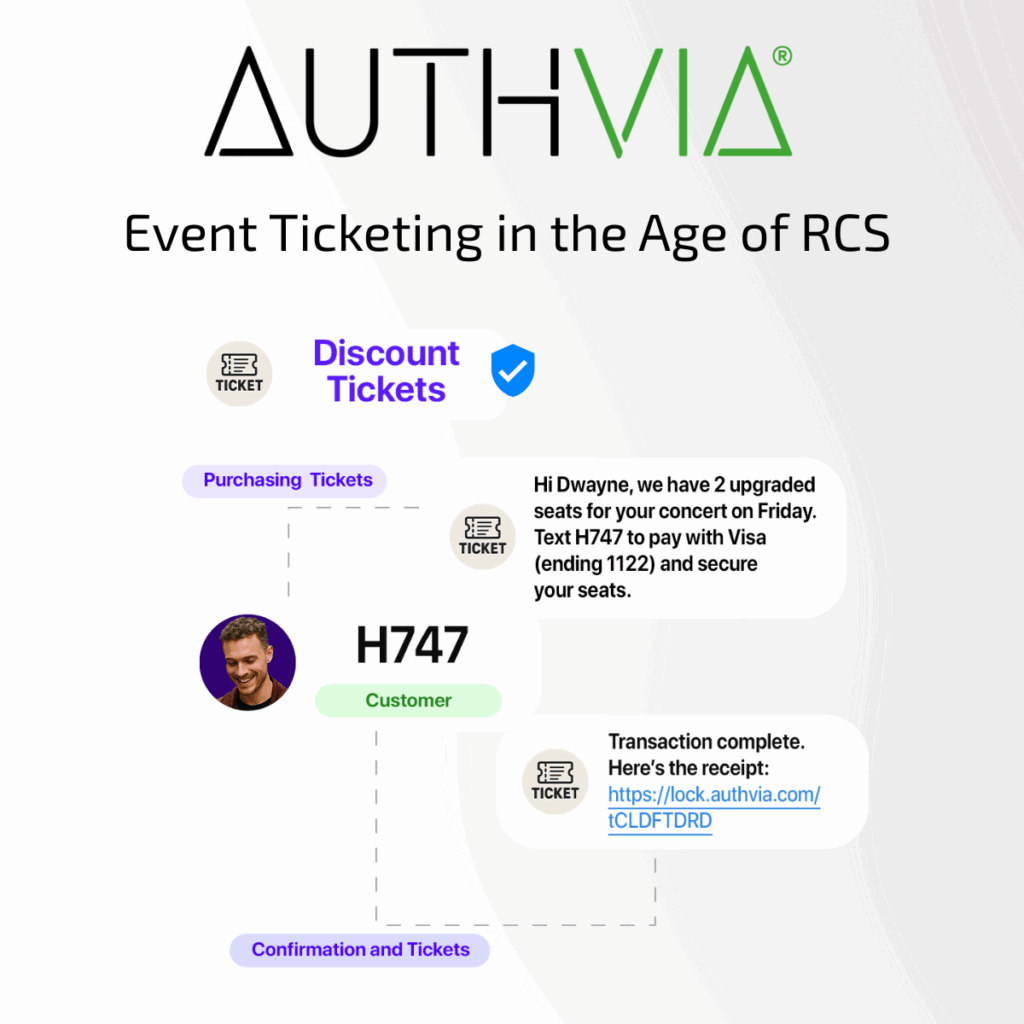

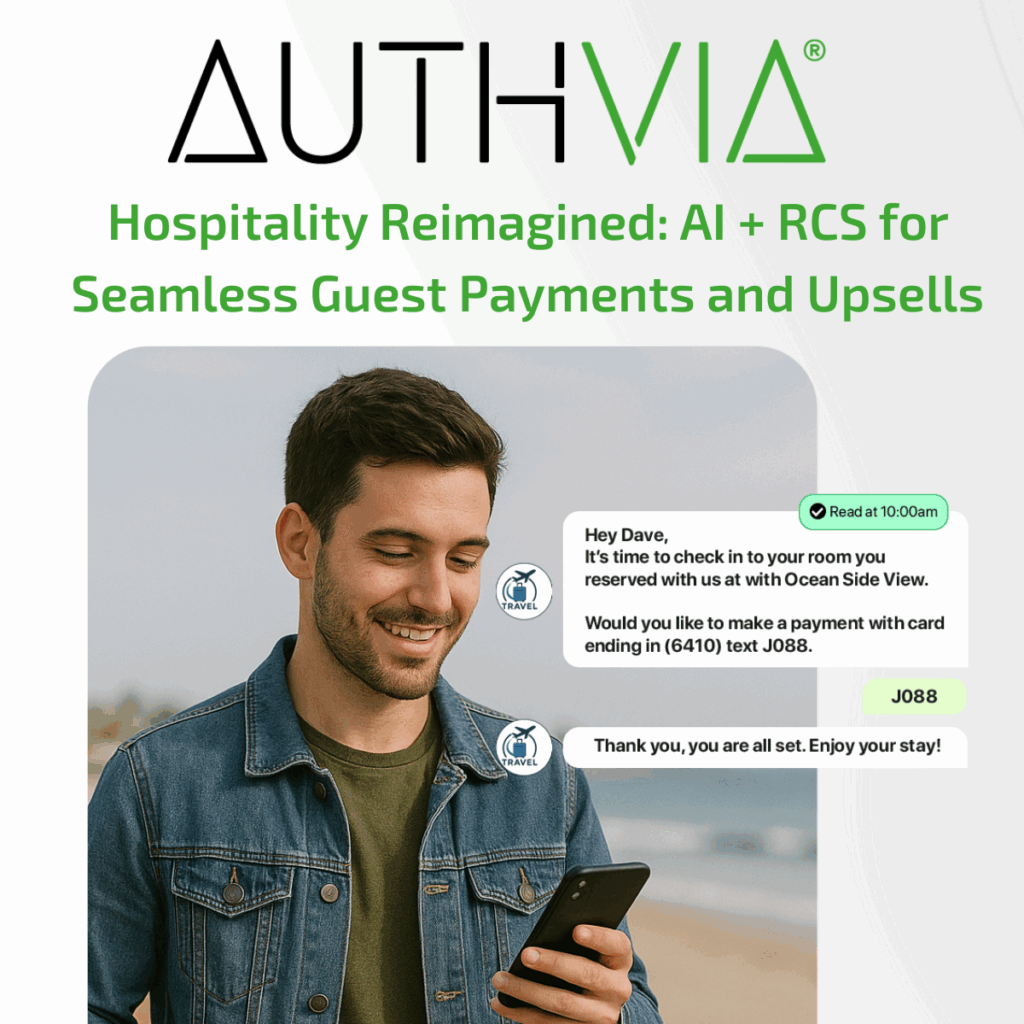

The longer it takes to collect, the harder it is for a business to reinvest or expand. Cash-flow crunches convince merchants to downgrade or quit altogether. - End-Customer Experience

Consumers expect mobile, two-tap checkout. Old-school portals and mailed statements turn into abandoned carts and service cancellations, metrics the merchant still pins on the ISV.

The Managed-Services Advantage for ISVs

| Problem for Merchants | Managed-Services Fix | Impact on Your MRR |

| PCI burden & fraud risk | Tokenized TXT2PAY® links keep card data off their network | Merchants stay compliant without extra cost |

| Late invoices & phone chasing | Batch bill 10 or 10,000 customers in minutes | Speeds cash flow, boosts satisfaction |

| High support load | Authvia handles send schedules, retries, & reporting | Fewer tickets land on your success team |

| Consumer payment friction | One-tap pay links in SMS, email, or QR | End users pay faster > merchants attribute win to your platform |

How It Works

- Plug the API, Not Another Portal

Authvia’s API sits behind your existing invoices or notifications. No extra logins; no app download. - Batch Billing in Two Clicks

Merchants drag-and-drop a CSV (or sync via webhook). Authvia auto-formats the file, appends branded pay links, and fires compliant SMS, RCS, or email messages. - Automated Dunning & Retry Logic

Unpaid invoices trigger reminder flows with escalation rules, no agent time required. - Real-Time Insight

Merchants (and your customer-success reps) see delivery, click, and payment status in a single dashboard, closing the visibility gap that fuels frustration.

Why Managed Services Slash Churn

- Time-to-Value Shrinks – Merchants start collecting digital payments in days, not quarters.

- Cash Flow Improves – Automated reminders speed up payments by up to 44%.

- Support Tickets Fall – Fewer “how do I take a payment?” calls lighten the load on your CSMs.

- Competitive Moat Widens – When you solve payments and software, switching vendors feels painful and that’s exactly what you want.

Go-to-Market in Three Sprints

- Sprint 1 – Smart SMS

Launch branded pay links with zero engineering lift. - Sprint 2 – Batch & Auto-Retry

Upload invoices, set schedules, watch DSO drop. - Sprint 3 – Fully Managed Flows

Offload template design, compliance, and reporting to Authvia’s desk while you focus on roadmap features.

Each sprint is modular, so you can pilot quickly with a subset of merchants and expand only when results hit your KPIs.

Ready to Keep More Merchants?

Authvia’s Managed Services bolt onto your platform in a matter of days, no gateway migration, no new UI, just faster revenue for your customers and stickier MRR for you.

Book a 20-minute demo to see batch billing and TXT2PAY® in action, and learn how a single API call can fortify your churn-defense strategy.